(2019-08-19)日韓貿易戰越演越烈,而台灣民生快消市場深受日韓進口產品影響,究竟這波貿易戰是否會掀起蝴蝶效應推波至一般民生消費品,來聽聽凱度消費行為研究經理Jackie Lee的看法。

日韓貿易戰持續 凱度於快消品界怎麼看

Enlarger Trade War of Japan and Korea brings impact towards FMCG?

日韓貿易戰越演越烈,相互限制原料或成品的交流與貿易,從半導體科技業陷入斷鏈危機,也讓凱度消費者指數反思,台灣民生快消市場深受日韓進口產品影響,究竟這波貿易戰是否會掀起蝴蝶效應推波至一般民生消費品,來聽聽凱度專家的快問快答:

凱度消費行為研究經理Jackie Lee,於韓國擁五年零售與消費行為研究經驗,現駐點凱度台灣,服務台灣客戶包含美妝類/個人用品類/保健品類等,將提出針對日韓貿易戰的見解與觀察。(本篇由凱度資深新事業開發經理Peggy Liu整理)

How serious is recent Trade War between Japan and Korea?

一直以來日韓有歷史情結(此不贅述),偶會發生日韓彼抗爭現象,甚至是跨領域跨產業的,而這次的日韓貿易戰據觀察為近年最嚴重也最大規模進行的一次。

據日本《讀賣新聞》報導,日本於8月2日決議將韓國剔除在安全保障出口的「白名單(White List)」之外,宣布後,韓國也表示將採取防守措施,這對日韓之間的半導體貿易與電子產品恐受到打擊,也將影響科技業端的中小企業鏈(當地製造商)。

From long ago historical background for Japan and Korea, there will be against continuously cross industry from time to time, but this year it became fiercely and much large scale, according to JP news Yomiuri, Japan announced on Aug 2nd to from remove Korea from trade partnership ”white list” then Korea responded the defense, which would lead huge impact towards both sides semi-conduct industry supply chain for electronic devices also tech-chain local manufacturers.

資料來源:https://www.yomiuri.co.jp/economy/20190804-OYT1T50127/

Foresee impact towards FMCG market according to observation?

於韓國,也諸多來自日本的民生快消品,從食品到非食品都有涵蓋,將端看後續原物料端的影響;而美妝業亦是如此,如以日本美妝指標品牌SKII,銷售表現將直接受影響,唯目前於韓國美妝市場仍以韓國兩大美妝集團(AmorePacific/LG)為大,因此在韓國的日本美妝品牌影響層面較為有限。

In Korea, there are plenty of Japanese imported FMCG products including Food and Non Food categories, we could keep monitor if the Trade War brings migrate to ingredients field and towards end products.

Take Beauty Industry as example, Japanese leading brand SKII monitored to drop sales in Korea recently, however, in Korea Beauty market, still AmorePacific Group and LG Group are the Queens, therefore Japanese beauty brands impact are seeing less.

Any Retailer side perspective or action to take?

其實有的,於韓國已有量販通路直接以標語方式標示,將暫不陳列或進口日系品牌啤酒,亦不再提供價格促銷。

Yahoo新聞也報導,上千家零售店主已暫停日系產品訂貨,韓國量販龍頭之一E-Mart也表示,近一個月日系啤酒品牌Asahi/Kirin/Sapporo/Suntory銷售業績下滑25%是前所未見的,而同期韓系啤酒銷售提升7%,可見其影響。

In fact, some Hypermarkets are pulling at imported Japanese beers from shelves and have stopped giving price discounts to Japanese beers as well. Also, according to Yahoo news, around 3,700 members of a South Korean grocery store owner association have stopped orders of some or all Japanese products.

Sales of Asahi, Kirin, Sapporo and Suntory beer fell nearly 25 percent in the first two weeks of July compared with the second half of June. "This is a sudden drop we haven't seen for a long time," an E-Mart official told AFP, adding that sales of Korean beer brands were up around seven percent in the same period.

資料來源:https://news.yahoo.com/south-koreans-boycott-japan-beer-brewing-trade-row-042253784.html

Within Digital Transforming World, how Digital plays the role differently?

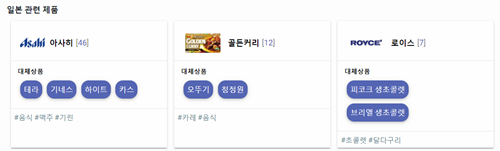

針對此次事件的數位化影響,目前於韓國已有新創網站「노노재팬(nono Japan)」將各產業別日系品牌品項整理條列,並提供替代品牌,以作為合作採購或一般消費參考,以快消品牌為例,如以日系啤酒Asahi查詢可見替代啤酒品牌如Terra/Guiness/Hite/Cass;如日系咖哩塊Golden Curry可見不倒翁(ottogi泡麵品牌)/清淨園(CHUNG JUNG ONE調味醬品牌)等,由數位化引領另一波鍵盤資訊戰。

Digitalize world did lead different impact, now in Korea we see new website of “nono Japan”, an informatic website trying to list all Japanese Brands info by industry and provide replacement list of Non Japanese brands.

Take FMCG brands to search on the website for example, Japanese beer brand Asahi would be able to replace by Terra/Guiness/Hite/Cass; also Japanese Golden Curry might be replaced by ottogi/chungjungone for merchandise cooperation or daily shopping reference.

資料來源:https://www.nonojapan.com/

What's your perspective towards some news reveal that Taiwan might benefit from the Trade War?

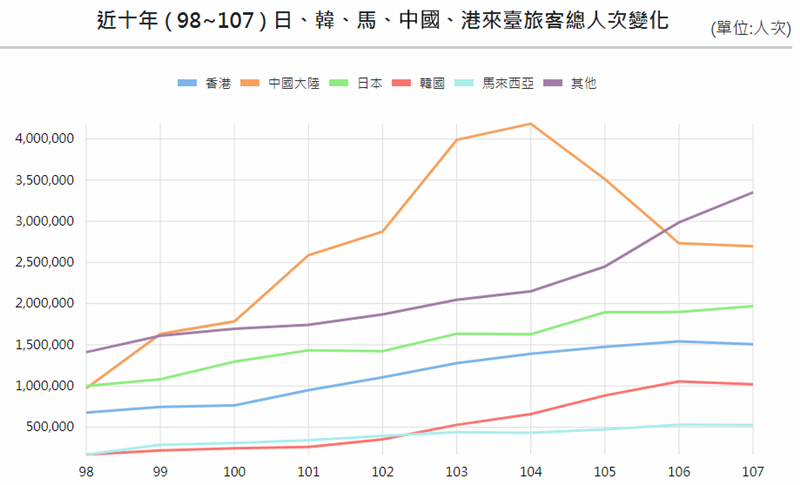

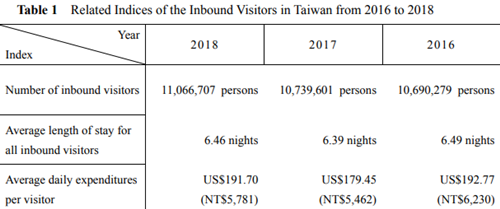

目前貿易戰持續跨大,將影響跨領域產品供應與企業端,若進一步從消費力角度思考,首當其衝將為旅遊業,根據交通部觀光局統計數據,2018年韓國來台旅客已達100萬人次,較兩年前成長15%,可試想當韓國人出國旅遊目的地從日本轉向台灣(或亞洲其他國家),初步估算其對於當地消費市場的衝擊與影響。

如韓國來台旅客與日本來台旅客可增加50萬人次x來台旅客每人每日消費約200美金x造訪台灣6天=則日韓來台旅客貢獻可達180億台幣(6億美金),將可能受惠的「您」準備好了嗎!

Since the Trade War expanded, that would affect product offering and business from all over, let’s try to think from Consumer Behavior side – say Travel Industry – according to Taiwan Tourism Bureau Data, 2017 Koreans Travelers in Taiwan had reached 1M people and growth 15% versus 2 years ago, what if Korean people turn their travel destination from Japan to Taiwan(or other Asia countries), the potential contribution could be foreseen – roughly estimation of tourists growth wave 500K shoppers from Japan and Korea x USD 200 avg tourist daily spend x stay 6 nights = potential inbound NTD 18B(USD 600M) – Shall all get ready for the Impact!

資料來源:交通部觀光局觀光統計資料庫